Store Formats & Concepts:

An area where there has been a great number of developments is store formats, indeed this demonstrates that the business is able to experiment effectively given the news that profits would be reduced this year (2012/2013) with the investment in the UK business.

Innovation is something that Tesco have simply not given much consideration to, particularly as they focussed on continually driving hours out of the business to drive profitability, It then became clear that the standardised efficient operation of a store was more important than any attempts to make things aesthetically pleasing in an attempt to drive further sales.

Tesco shy away from Whole Foods levels of presentation.

Similarly there wasn’t an acquisition driven agenda either, I don’t mean chains – indeed Tesco had bought up large tranches of convenience stores like T&S to bolster the Express estate. It’s more the ‘take a stake’ approach in niche businesses that can provide differentiation that I think is very smart.

The 49% stake in Harris & Hoole caused a storm in the media with the usual cheap headlines ‘cloak brands’, ‘a disgrace’, ‘how dare Tesco take 49% and not change the name, fooling us all!’. Missing the point, Tesco don’t want to put their name and branding all over Harris & Hoole, they want to use H&H to add to their stable of venture brands such as Parioli and Chokablok, as well as putting a part owned Coffee shop into their Extra stores.

Business wise, this makes more sense by adopting the WalMart approach of eliminating ‘margin takers’, Costa Coffee pay a fee for space in Tesco stores but utilising Harris & Hoole would see Tesco take more of the profitability via these concessions. In addition helping to develop a niche brand like H&H with exposure to huge numbers of customers.

It then also opens up the possibility of introducing Harris & Hoole branded Coffee into the main fixture, similarly expect Giraffe ready meals to be introduced into the range as soon as is possible.

Another chain shrouded in whether Tesco has bought them entirely or indeed taken a stake is Euphorium Bakery, an artisan bakery based in Islington, London. Tesco actively hire for roles within the Bakery unit and indeed the concessions within a number of Tesco stores in the capital.

Euphorium focus on rustic bread and cakes of high quality, the product is really superb and a hugely differential from anything else seen in the marketplace. I was very impressed with the cafe in Kensington which is also run by Euphorium, a real focus on artisan bakery lines, premium sandwiches and something that really complements the store environment.

Tesco have done a Vlog indicating the changes carried out within their refreshed stores it’s filmed at Kensington and there’s a short interview with Paul Jones who is head of store design. It can be found here.

Food to go

Kensington superstore represents the first real innovative fresh department for Tesco in many years, there is other work ongoing in a number of other superstores too. Express stores in the capital and Extra stores across the country are to benefit this year from store model changes too.

Chester was the first store to trial the ‘shop within a shop’ concept which imitates the Morrisons ‘Fresh 2 go’ concept with separate tills and a focus on food to go. There are real developments in the salad bar offer which features a pick / mix bar rather than the usual pre packed offer.

Kensington, Tooley Street and Regent Street Metro feature the new ‘food to go’ concept which is such a massive improvement, yes it’s not lean, there are colleagues in place purely to replenish salad bowls over the lunch period, bake off half pizzas (hugely popular) but it brings customers into the store.

Regent St Metro is a unique store in that it’s location (just off Piccadilly Circus) means that it experiences ridiculous trade levels, as such around 1/3 of this store is dedicated to food to go with roughly 1/3 dedicated to fresh food too. There is a smaller Grocery and GM range but the focus is very much ‘on the go’.

The food 2 go area is a major plus in the stores that have had the refits, it demonstrates a commitment to fresh food and indeed post Tooley St visit last year, I called for a larger salad bar in this blog! Food to go also features the core sandwich meal deal offering along with cakes, pastries and the news & mags offer is also condensed into this space.

The commitment to fresh is also evident with some of the developments in Kensington, freshly filled sandwiches (in store) are ranged along with a range of sandwiches from Euphorium. In Tooley St there is a crossover between Euphorium and Tesco sandwiches which offers choice but Tesco need to ensure that the offers are significantly differential otherwise it’s mere duplication.

Food to go is clearly a winning concept, the category has been completely overhauled and is working well for Tesco, typically the high street stores will garner the most from this focus, Chester for example is on a busy high street and it’s a similar story with Regent Street, London. That’s before we even consider which Express stores could house a smaller version of this, clearly Tesco have looked at the M Local model as well as Fresh 2 go in the fresh format stores too.

Tesco have a wealth of information to accurately forecast which stores this concept can work in, it now appears that they’re starting to work on the concepts that will bring elements of differentiation into their stores.

Fresh Food Counters

The counter offer in Tesco is another element that has been neglected, with the ongoing obsession to drive efficiency within the business, many counters were replaced by pre cut product to save on staffing costs. It made sense at a high level in terms of costs vs. sales but customers like fresh food counters, it reminds them of their local butcher, deli or fishmonger.

The refreshed stores across the country have had their counters revamped, featuring the wooden signage and smarter PoS, Kensington features this as a base but also a lot more around a tailored offer and complimentary products across the range. There is no counter offering in Regent St or Tooley St given their size, format (Metro) which restricts space and focusses on top up shopping.

The most impressive thing about the counters ‘square’ is the location in store, it’s literally within the entrance from the high street. The car park entrance means you have to walk through Produce first but nevertheless it’s an impressive location and offer.

I take the point that Kensington is an area where anything could be sold, however that’s not to say that Tesco are complacent with the store ranging. Not at all, everything makes sense, it’s very cohesive and the ends dedicated to Finest products are common sense. The Meat & Fish counters for example range premium cuts of Meat and Finest Joints to appeal to those affluent customers wanting something a little more special.

There is a real focus on catering for the customer ‘in a hurry’ too with pre packed counter product labelled ‘ready to go’. Fish, Sausages and joints of Meat are all merchandised within the counter area as such. There remains a real opportunity to enhance the marketing with the price labelling, the labels used are generic and give the impression of a cash and carry rather than a supermarket.

The Deli expand their fresh range to cater for the local area, ‘deli meals’ are available with Lasagne and Mousakka pre made and sold to heat up at home, appealing to those customers preferring a fresher alternative than traditional ready meals. There is also a wide range of fresh Olives and premium salad options available for customers.

Produce & Floral

Once again, the main signs of innovation came from the superstore concept in Kensington, though lowered displays in the Salford Extra store are a step forward, allowing the customer to see across the department and also featuring better lighting.

The mister is a nice attempt at differentiation, where it fits I’m not entirely sure. It doesn’t have the ‘wow’ like Kirkstall does with the full first table featuring a misting unit but it’s interesting to see it featured. The lowered table featuring Citrus fruit makes more sense, it evokes memories of a market and displaying bulk citrus fruit is made easier by the low level table.

Bringing theatre to the store environment is never a bad thing, little tweaks like the Living Lettuce end, featuring Lettuce which grows, merchandised in Water brings interest to the range and provides Tesco a chance to educate customers. I like this, it’s perhaps one of the biggest indicators that Tesco have changed their approach to stores.

Lowered displays are a key part of the new look, customers don’t want to see walls of crates, particularly when they’re empty so lowering the displays at an angle to allow customers to see across the department is a smart move. It enables navigation for customers to become easier as they can find products easier, just by looking across the department.

Tooley St and Regent St remain with a standardised Produce offering, the focus in these Metro stores is significantly different given the differing shopping missions. Kensington focus on the full shop given the Superstore model so a wider range is important.

Produce remains a huge part of the picture within Tesco and I’d hope for further innovation as this year goes on, it’s a major department in the store and it’s not necessarily as sharp as it could be. The changes in Kensington are really positive and it will be interesting to see where else these changes appear.

Bakery

I’ll turn the focus to Bakery within these store concepts now and I’ll try to keep product range separate from store formats as they’re two entirely different things. Produce and Bakery for me are the ‘destination’ departments within store, both fresh food based and both selling staples – Fruit & Vegetables along with Bread.

Get these right and the store will perform well and bring in customers and more importantly drive their loyalty due to the quality and importantly availability of staple foods.

As noted above, Euphorium Bakery are now involved in stores particularly in the capital and it remains to be seen whether it will work its way up the M1 within the Tesco estate. In Kensington, the store has a full Euphorium bakery (with Cafe) along with the core Tesco offering of 400g /800g loaves, Doughnuts and Rolls.

The store is very aware of the demographic the store serves and as such has a very strong world foods offering. On Bakery, there are a number of regional loaves baked and labelled with their nationality. Superb. It’s likely to really drive sales and also ensure the store offer is effectively discussed locally, bringing more customers in.

The Euphorium bakery then follows, the core range of Bread is taken care of via Euphorium but it’s within the standard Tesco range. The offer is superb, all Breads are displayed naked with specialty bread and loose rolls available, it looks rustic, genuine and demonstrates real quality. Unlike anything else we have in the UK market.

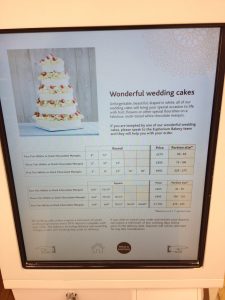

Euphorium also offer celebration cakes to order, this is a great move and particularly with the quality of the product. The Cakes are of such quality that it won’t just be birthday parties that will be of interest, it’s likely to appeal to customers shopping for all occasions.

The extensive range of Euphorium Cake and Breads does extend the question around duplication, particularly in Kensington. Is there a need for the wide range of own label Tesco celebration cakes too? Or is very much serving the different demographics within store?

Another odd ranging decision is within the Tooley St revamp where Tesco have a strong Euphorium offer in the ‘food to go’ range along with a tightened ‘Your Bakery at Tesco’ offer.

There is also prepackaged Cake towards the other end of the store within the core Grocery offer, ranging less fresher Cupcake ‘platters’ for £5 makes sense at a high level for the nearby offices. But, if Tesco are serious about taking their fresh offer to the next level then why not offer fresh Cupcake / office deliveries via Euphorium?

With Bakery, quality is absolutely vital and it’s vital that the guys in all Bakeries up and down the country are given the tools to do a job. As ‘Ideal Schedules’ come into force (a guideline for how the job needs to be done, how many staff are needed etc), Bakery should be very carefully considered.

There are a number of variables in retail as we discussed in the last blog, and Bakery is one of the departments which is unique in the sense that product can be produced in store. A Milk delivery fails, then there’s no Milk on sale however if Bread runs out, the expectation from senior management is that flour, water, yeast and the mixer are there – get it made.

However, this requires time, packaging and staff. Similarly Cookies are baked from frozen but gaps cannot be filled instantly, staff are needed to tray up, bake off, allow to cool before packing, labelling and replenishing. Staff cover is needed to ensure this is done ‘just in time’ rather than encountering availability issues – off sales = lost sales.

Variability of weather conditions affects the store but particularly Bakery, warm weather leads to a deluge of customers wanting rolls for their burgers and hot dogs… A lack of staff will see those sales walk out of the door and up the road to the nearest competitor.

Euphorium is a great differentiator, it takes the Bakery offering to a new level in stores and of course, it’s demographic dependent but expect Euphorium to appear in a great number of stores in the year ahead. Putting ‘food first’ as Philip Clarke said at the results today.

Fresh Foods

The core fresh food offer remains as a standard offering even in these concept stores, packaged fresh food is a poor relation to the open fresh food counter offering in any store, even more so in stores like Kensington and Tooley Street.

Perhaps the biggest development in Tooley Street is the addition of the sliding door refrigeration units, saving energy as the doors are closed when customers aren’t browsing. This isn’t anything new of course, these were in place when I visited the store in March 2012.

Beers, Wines & Spirits

A category that is a necessity in every store but often doesn’t go much beyond the core range, the London stores have also seen their core BWS range expand in line with the core demographic.

Suppliers are working with Tesco to work on various concepts within their categories, this is good news as the supplier / Tesco relationship had broken down somewhat in recent years. Another benefit is that it brings new ideas and expertise from the companies who really understand their category.

The bay dedicated to Prestige Champagne for example once again is a case of differentiating the offer significantly, there is a heavy focus on gift purchases with display boxes and bags. Also featured was a LCD screen advertising the various brands featured.

Core Grocery / World Foods / Non Food

Unsurprisingly, the core Grocery area in concept stores is untouched. There’s little that can be done with packets, cans and jars, indeed the fresh format stores Morrisons developed found the same issue. It’s very difficult to get the ‘wow’ effect.

What Tesco do very well is ranging, it’s to be expected with the wealth of Clubcard data available to the ranging teams so World Foods in particular is an area that Tesco excel in.

Philip Clarke and Chris Bush also discussed the reduction in non food at the results today, it’s as much as we expected really; reducing the non food space down to only complimentary to food (cookware) and the core long term non food categories such as Stationery, Games and a range of toys.

What’s interesting with the Tesco stores in Tooley St, Kensington and Regent St is that they feature a small range of electricals, even Regent St has a Direct pod to order non food along with an area selling Kindles to appeal to the customers on the go.

Regent St is perhaps the best example of a tailored focussed non food offer, there’s a range of Stationery too along with some ‘free from’ food and a tiny (8ft) cabinet for Frozen Foods. Reflecting the customer missions and in addition a demonstration of making the space work very hard for them.

A real step forward in these stores with regards to tightening of non food, focused ranging and a real understanding of the customer missions in these stores.

Own Label Quality

Horse meat meant that the own label of Tesco took a real knock, however the work on the product range goes on, Philip Clarke noted that Meat had been revamped twice in 25 weeks, the first time saw new signage and a tightening of the range. The secondary relaunch this week saw a number of provenance aspects noted and backed with PoS.

Prior to that, Meat had not been looked at for 4 years, that perhaps sums up the lack of focus on the UK core which Phil Clarke has strived to recapture. Particularly today where he spoke almost sadly about how Tesco used to be market leading, and how he intended to ensure Tesco were market leading once again.

Setting out pledges like being ‘food first’ when considering store refits and builds is vital and shows that they’re really starting to understand what is important in the UK and also the fact that this lack of focus has cost them market share and sales.

Improvements like the Ready Meal revamp saw little in the way of real innovation, it was more about increasing the meat content in the existing meals. That’s great, but it’s an acceptance that the existing range wasn’t good enough, there needs to be innovation and a bit of differentiation.

The work carried out so far on Everyday value for example was very positive, there has been some work done on the Dried Pasta, areas of Produce and also some further work on Bakery, the sweet range has been changed with new packaging but it can be a little confusing for customers.

As the year progresses, the rest of the range will be revamped. My feeling is it will be purely a benchmarking exercise to get Tesco back ‘in the pack’ so to speak. The next revamps will then seek to differentiate first by range and store and secondly with innovation and differentiation versus the competitors. The Finest revamp due for later this year is eagerly awaited, this should see a real statement of intent from Tesco.

So, a lot to do! There’s a lot of work involved for the store teams who have re-merchandised categories and handle the new ranges whilst others are sold through.

It needs to be right first time, existing store teams will struggle to cope with the volume of work, particularly on more time consuming categories such as Health & Beauty. Consideration should be given to supporting the store merchandising team with more hours, ensuring that the effect of any revamp delivers the ‘wow’ it should do.

Philip Clarke set out today his plan for the future for Tesco, a big hit to profits makes sense, clear the decks, get the business fit for growth. He spoke a lot about centering things around food, this makes sense too and is music to the ears of customers, analysts and colleagues alike I’m sure.

Online and multi channel continues to grow, Tesco are well placed to capitalise given they have their offer developed across click / collect, .com and Tesco Direct. Allied to that is the development of brand such as Euphorium, Harris & Hoole and in particular the Giraffe restaurant chain.

Social Media is an arena where Tesco are really blazing a trail, stores, directors and the company have Twitter profiles and the business are really embracing this arena. It allows Tesco to speak to customers directly and looking ahead to the new ‘voice’ in which Tesco want to speak to customers, social media will be vital in the age of the Internet.

There are a lot of positives from the first year of Phil Clarke, long overdue store concept trials are excellent, a lot of advances in the offer (albeit from a low base) but growing upon growth is always a challenge, can Tesco do it? Time will tell but their confidence is growing and the team seem to be well up for the challenge.

It’s all about consistency, delivering ‘the best shop in town’ day in, day out.

Are you a retailer? Perhaps an international retailer wanting insight on the UK? Are you a Supplier? Or even Tesco? Grocery Insight offer bespoke insight on store concepts, store operational routines, ranging and the wider UK market to help with your business.