Part 1 can be found here and charts the entirety of market square / fresh market and the flower shop, the first half of the store which is the ‘fresh’ half if you like. I’ve split the blog into two parts to condense the read and in this one I’ll draw some conclusions around Wrexham and the Stores of the future.

|

| The customer service desk is part of the fresh market. |

Another element to arrive at Wrexham is the advent of the ‘chef’, whilst it’s seen as gimmicky having a chef cooking away whilst he speaks over the tannoy, it does seem to drive sales as there were a number of people asking the chef questions as he cooked whilst speaking over the tannoy.

|

| The chef cooking away – adding pizzazz to the shopping trip and driving sales. |

|

| Associated lines from the chefs demonstration. |

The lines he uses are featured in a unit nearby so it can help to drive sales, it does provide theatre and sees customers walk towards that area. It gives them confidence to try new lines too, with Morrisons being able to offer more cuts of meat / fish and indeed the wider vegetable range, it makes sense to have someone there who can explain what to do with the new ranges.

|

| New signage for Chilled Dairy and Juices. |

|

| Chilled and Dairy goes down the back wall into the other half of the store. |

The second half of the shop after the fresh market contains the rest of the store, that is Grocery, H&B and the core Fresh shop (milk, butter etc). The fresh food space runs along the back wall of the store and there seems to be an absence of gondola ends for fresh with the Safeway ‘hotspot’ making a re-appearance.

|

| Hotspot in the aisle for chilled dairy. |

Frozen foods also has a gondola end but also has a hotspot, that is promotional space within a main aisle rather than on the end. Morrisons have traditionally focused heavily on gondola end promotions and for Grocery (though reduced) this does continue but for fresh and frozen, extra promotional space is driven via the addition of a couple of hotspots. I guess you could argue these aren’t typical hotspots, as in in the middle of an aisle but nevertheless these are not typical ‘ends’.

|

| Frozen signage. Still an important area of the store |

|

| New POS on show and the frozen hotspot. |

The main grocery ends remain and the strategy of strong promotions enticing customers into the store looks set to continue, despite the grocery side of the operation being very different to the fresh market. It’s still notably important to ensure the grocery offer is strong.

|

| New signage for Grocery |

|

| Vital that the Grocery offer remains strong |

|

| Core grocery on deal is of increasing importance in today’s climate. |

Liberate seems to have done a remarkable job of freeing up space in trial stores but as Dalton noted at the half yearly results,areas such as biscuits could have been cut harder whereas they were hit other areas too hard so it’s not an exact science and will probably be looked at on a store by store basis. It’s vital to free up space whilst not to alienating existing customers, shifting poor selling lines is in everyone’s interests though both from a working capital viewpoint as well as a space management viewpoint.

|

| Bulk stacked ends ready for Christmas |

What is notable about the store is the lack of non food, whilst Morrisons stores generally don’t have vast swathes of non food, certainly not in comparison to Sainsbury’s, Asda or Tesco. Wrexham appears to have a notably limited range, rather like St Albans which is another store of the future conversion.

|

| Non food assortment encompasses games, electricals, toys and magazines. |

|

| Growth areas like party goodies also indicate a shift in strategy regarding non food. |

Whereas Kirkstall does have elements of a range with some homeware lines, Wrexham appears to focus on electrical basics such as microwaves and toasters with bedding and towels also available, not bays upon bays of non food by any stretch but a functional assortment.

|

| Lottery, Cigs and Dry cleaning are placed behind the checkouts. |

|

| Magazines also form part of the non food space assortment. |

The space mix seems to be reduced against core stores, stores like Kirkstall have a wider range so it’s a clear sign that the Liberate programme isn’t being used to free up space for non food. Especially with this being a new store and as such having a tighter food range considering the wider fresh food space.

|

| Wrexham has a smaller range of non food than heartland stores or indeed Kirkstall |

Dalton indicated in the Sunday (27/11) Times that there is little point having a massive assortment of non food in stores. Not only considering that the market is really struggling at the minute but with their push online to come shortly where they’ll sell non food and Wine. It simply makes no sense to give up store space when they’ve an expanded fresh food offer to find space for and an online platform to utilise for the non food.

|

| Peacocks clothing concession in Wrexham |

|

| Jewellery also features within the wider offer |

|

| Branded make up displays share space with Peacocks childrenswear |

What Liberate does make space for is a kids clothing assortment, clearly research has come through indicating that Morrisons shoppers with families want kids clothing and with pressures on fuel leading people to save money and combine shopping trips, it makes sense to offer as much as possible under one roof without being hugely exposed to a downturn in non food.

|

| Toys and stationery also feature on non food. |

It also lends itself to a change in strategy that Morrisons are trying to ‘win with families’ with the Kirkstall revamped H&B offering tying up the baby offering and the Peacocks kids clothes concession appearing in many of the stores of the future. Interestingly Wrexham is the first store to give space up to Kiddicare products, that is permanent space and not seasonal space where some Kiddicare lines have appeared in the past.

|

| Kiddicare lines in Morrisons Wrexham |

|

| Lines will drive extra margin and see customers come to store to purchase. |

|

| A small range of baby toys also form part of the range. |

The Kiddicare tie up is interesting as it’s taken a while for the lines to arrive in a store, and whilst it’s non food it’s likely to perform well for them considering there is always a need for good value baby product, especially as the financial situation for many continues to worsen.

The margins will be good and as such Morrisons can afford to be price competitive on the range, it’s real complimentary non food and will drive people to the stores along with fresh, especially as the word will get around that Morrisons own Kiddicare and discounts are available online.

|

| 5% off kiddicare.com orders if you mention ‘Morrisons’ at the checkout screen (note the shelf ready packaging!). |

|

| A solid range of nappies too |

The Beers, Wines and Spirits section is modelled on Swinton due to Wrexham having more of a value driven demographic. The Kirkstall layout has Wines are merchandised by flavour and taste rather than country of origin as is typical in many other stores.

|

| Beers, wines and spirits signage |

|

| Red Wine under £8 |

|

| Special offer area for Wine. |

Swinton merchandises wine by type and within a price bracket, so there is a display for Red Wines under a £5, under £8 and the same with White wines too. It’s a value driven merchandise plan and perhaps more affluent stores will benefit from the wines by taste fixture like Kirkstall with stores with a value focused demographic retaining the price driven plan.

|

| White wines – Under £5 and Under £8 |

The white / red wine that is over £8 is given less featured space on the aisle, so it’s clear that this is a value driven exercise and it will drive purchases. Cost conscious consumers are likely to cut back on ‘luxuries’ such as wine so offering an option to investigate lower priced wine will help the department be more enticing and force customers to have a look.

|

| Despite all the new elements, traditions such as a strong range of beers remain |

|

| As does the wide range of lager |

|

| Liberate also sees items such as mixers and tonics live within the Spirits fixture |

There is a real faux wine shop feel to the department with unpainted wooden fixtures giving the department a real rustic feel, there are concerns over the durability of such fixtures, especially when clattered with a passing blue pallet for example.

|

| Wine with food type suggestions too. |

Tying up the market feel is the emergence of the unit which indicates which wines are ideal with food types, there are suggestions for red meats, seafood and white meat. A very positive move by Morrisons and surely it would help drive sales, although I feel an opportunity has been missed by not finding room for the unit by the butchery and fishmonger, surely that would drive sales and tie up the evening meal market.

|

| The cafe has also been rebranded in Wrexham |

|

| The cafe has had a new look, much more coffee house than supermarket caff! |

As Morrisons move towards being a real food specialist and offering fresh food in the fresh market, the cafe should follow with a strong offer showcasing the best of the food available, at the minute it’s still a relatively functional menu. I’m told that a relaunch is due with the M Kitchen chefs busy at work reformulating the meals and developing new dishes for the cafe.

|

| Full view into the prep areas. |

|

| M cafe keeps within the theme of the store and the new look. |

A careful balance has to be struck though as the M cafe has gained a reputation throughout the country for good food at a great price, it’s a point of difference and remains popular, I hope that any new relaunch of food retains this ethos.

|

| More evidence of the consistent theme throughout – menu board. |

The M Kitchen ready meals are a brilliant package, it’s come together well in stores but criticisms have remained over price increases, it’s a better quality of food admittedly but in the current climate, every penny counts.

|

| Pizza and Sandwiches are also available. |

The petrol station also has a rebrand with it now being labelled ‘refuel’ which covers both the person and the car presumably, additions such as a coffee machine into the petrol station shop certainly add credence to the theory with other lines such as doughnuts and cookies also available.

|

| Petrol station is now ‘M Refuel’ |

The company is coming along quickly under Dalton and they continue to be aggressive in the wider marketplace with their offers and pricing, the new look and feel of the stores of the future is a big positive, in particular the font family, colours and feel of in store signage play a big part.

|

| Signage that sums it all up, local community, history and the future – new fonts and theme. |

|

| Local lines in Wrexham – though no Barry tea! |

|

| Smaller signage on ready meals |

Certainly it was a huge criticism post Safeway that stores went backwards 10 years, not in terms of a business model, but in terms of the feel of the store, replenishment and availability were far better, as was the pricing structure and promotional package but the stores looked dated. Perhaps more so than in the heartland as they replaced far ‘fresher’ and more modern elements as they were converted to the M format.

|

| No hanging POS in Wrexham advertising M Kitchen. |

|

| M Local subtly advertises the M Kitchen range |

The M Kitchen ready meals are all ranged within the store but due to the absence of any hanging signage in the new stores, there is no advertising for the new range. It will be interesting to see if there is any effect on sales considering the strong POS push when M Kitchen was launched.

|

| The new signage – nouveau Safeway style rather than Morrisons? |

Naturally there are also questions over where the ideas came from for the entire fresh market feel, I understand Weegmans in the US are a source of a lot of the ideas with their fresh offer. Naturally with Dalton’s history working for WalMart and Loblaw, there’ll be influences from there too.

|

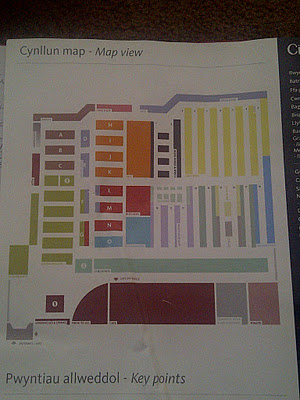

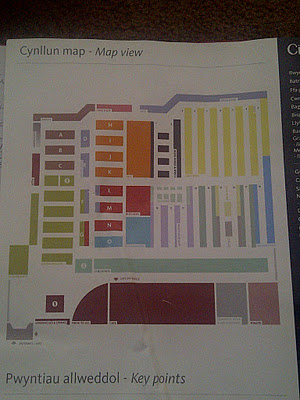

| Wrexham store map |

|

| Loblaw trial store in Milton – store map. |

The similarities between the two stores are striking, namely that the fresh is grouped together, admittedly there are differences as Morrisons have put the counters in a u shape across the fresh market. Bakery is at the front of the store which is another difference but the similarities such as health being in the middle of the store near checkouts, fresh food being in the first half of the store with Grocery following on.

Dairy going along the back wall is another similarity as is Frozen being tucked away at the bottom of Grocery and it’s interesting to see influences coming in from across the pond.

|

| Loblaw annual report – elements in Wrexham? (c) Loblaw Canada |

The Loblaw store is bigger than Wrexham so as a result there is more room for non food and ‘Joe’ which is their clothing range. Dalton has already indicated that non food space doesn’t make sense in stores as they’re going online with it and to be fair, the market is hardly supporting expansions into non food at the minute.

As for current trading, one of the correspondents was in the area yesterday and said store had done notably good money first week, easily beating target but there were issues developing with availability, fresh food is acceptable (to an extent) as the forecasting system will need time to develop a sales history and whilst the store can be flooded with product, but then wastage could be a concern.

|

| Availability remains an issue in the early days |

Bigger concerns will be over grocery availability, with a few gaps being observed and with the manual controls, this will be a concern as customers switching over from other supermarkets need to have the full package in terms of both fresh food and Grocery, especially as core grocery remains such an important part of the store.

The promotional package is important and another interesting point is there appears to be a reduced number of grocery promotional ends as the grocery floorspace is reduced in comparison to a standard new build for example. The fresh strategy is a positive and space has to come from somewhere so Grocery is cut back somewhat, is there enough room for a shelf to hold enough stock for a days worth of sales?

That’s the broad logic that WalMart use, providing the shelf is ordered to full capacity (certainly M can do it with their manual control) then the space given up will last for a days sales, naturally if things sell out then you can flex the space and give quick selling lines more room whilst cutting back on the poor sellers.

Whether Wrexham has enough space for the sales it’s experiencing remains to be seen, the gaps yesterday may well indicate that space management needs another look, especially if replenishment is required during the day for good selling lines.

It shows that the store has been busy in the first week, it will take time for things to settle down and sales history on both sides be available and used to drive sales, gaps are never a positive but it’s very early days for the store of the future. The fresh focus appears to be working and the margins available on that will drive greater profitability across the chain.

The future in store is positive if Wrexham is anything to go by, there may well need to be tweaks for the next store (Royal Tunbridge?) but the store is markedly different and a real store for the future. It’s interesting to note elements of Safeway thinking making their way into Wrexham too and a future blog will chart a few comparisons and similarities which will be interesting based on what’s been seen here and in Kirkstall.

All eyes on the new year and the rumoured 40 stores to get the update, some tired ex Safeway stores will be pleased!