Tesco have been striving for more efficiency for an age as they continue year in, year out to deliver a rumoured 4% labour saving via ‘step changes’. These system upgrades or ‘new ways of working’ mean time is saved across the vast Tesco estate which equates to a wage saving as the task is reduced or eliminated.

Increasingly this thinking is being driven by the Japanese ‘Toyota way’ of Lean, where everything is standardised and processes documented. Bringing standardisation to a process across a number of stores enables head office to standardise labour allocations and bring a common process to the replenishment process for example.

Sainsbury’s also have ‘simple coaches’ who are appointed to drive corporate improvements, adjustments in code control for reductions and other process improvements are driven with the target of continually improving efficiency in store. These improvements are continually evolving so initial labour savers such as shelf ready packaging are almost forgotten now, like the VHS of the home media world really. It’s now expected that suppliers with a new product will provide a shelf ready solution for ease of replenishment, some categories such as biscuits reach 98% of Shelf ready compliance in Asda, this represents a definite saving for the labour budget as time taken to replenish is reduced.

|

| Morrisons recently converted their garlic bread range to a full shelf ready solution |

In terms of shelf ready – along with a number of other efficiency aspects, Morrisons are very new to the game with regard to efficiency in stores, even though they run a relatively tight ship and still offer a better gross margin on products than Sainsbury’s despite the added cost of vertical integration.

There are arguments that Morrisons (and Tesco, out in front on the margin stakes) have lower rental bills which is as maybe, but lest we forget Morrisons own 87% of their sites on a freehold basis and aggressively look to build sites with other retail units on them to generate further rental income, indeed they appointed Cushman&Wakefield this week to manage the other retail units, as they try get some retailers into any empty units to drive footfall to the Morrisons store which is the anchor for these centres. As Sir Ken famously put it ‘we are not into the short term’, its served the business well.

The greatest drivers of efficiency are predominantly system driven, with a sales based ordering system like Tesco’s SBO, Sainsbury’s RSS and Asda’s Wal*Mart system, they generally tends to focus on exceptions / errors (20%) with the other 80% being automated and requiring little intervention. Exceptions may be overstocks, lines with a lot of wastage and investigations of gaps which save stores countless numbers of hours ordering the other 80% that look after themselves.

Hand in hand with systems is a drive to reduce overstocks which (broadly speaking) are not needed within stores otherwise they’d be on the shelf! Reducing overstocks saves manpower in warehousing is something that Tesco, Sainsbury’s and Asda have all done with varying degrees in recent years. Costs are saved as cases aren’t checked for replenishment, counted and then placed back in the warehouse for example – all tasks which cost money and increase the number of ‘touches’ on that case. Tesco have pioneered the move to ‘one touch’ replenishment in larger stores by leaning on suppliers to provide pre filled dollies and shippers for bulk items like Tea, Coffee, UHT Juice, Water and Fizzy Pop.

|

| Tesco have used the pre filled ‘one touch’ replenishment solution as used extensively by Aldi. |

To provide a contrast of the game of catch up that Morrisons are playing and indeed their vast potential to realise the £100m of cost savings that Dalton targeted, its useful to look at shelf edge labelling.

Both Asda and Tesco in the early noughties had the ability to ‘print from the hip’ where SELs could be printed on the shop floor rather than noting down SKU codes and walking back to the office, then walking back to the location with the SEL. Sainsbury’s added the functionality in 2005 and Morrisons rolled it out nationally just two weeks ago after a successful trial in York.

There have been system limitations with the existing ePOS software being replaced by ‘Pegasus’ as part of the Oracle suite but I don’t even think that’s been rolled out nationally yet. Nevertheless it serves as a useful example comparing across the market and looking where Morrisons are coming from with their process and efficiency drive.

In terms of SEL printing, an area of focus for Tesco was their advertising in store, previously each item on promotion would have a SEL with the offer on and then a ‘barker’ over the top which displayed the offer. In 2009 they abandoned the practice of hanging ‘barkers’ for advertising (unless it was on an end) and instead redesigned their SEL to tell the customer the offer.

|

| An example of a promotional SEL – information on one SEL – one movement / replacement (c) Hotukdeals |

Sainsbury’s do use promotional barkers but part of their lean strategy was to have one per shelf for each offer and have the SEL’s

|

| Promotional SEL but no advertising in Sainsbury’s. |

|

| Corporate standard of one barker per shelf despite the ‘stripping’ behind advertising the same offer. |

Asda have eliminated the use of barkers bar on the ends but use the rollback overlays and ’roundals’ that stick out into the aisle on each rollback or round price point (£1). Asda use ‘stripping’ which fits on the shelf and outlines the offer, they tend to not bother with any more advertising where stripping is present but may use ‘fins’ to show the customer that a certain ‘bay’ is one price point for example.

|

| Single price point of ‘£1’ stripping and fins – no on shelf advertising. |

Morrisons use barkers and in some respects the shelf stripping but their general offer is relatively standard, although a new ‘Safeway’ font style POS is being trialled at Kirkstall and perhaps that will be rolled out nationally? The main estate stores display barkers for offers but from an efficiency point, this is a particularly hefty display of them.

|

| 11 barkers over 2 shelves in Morrisons advertising ready meals. Price and offer are on the product itself. |

11 is unbelievably hefty and from a labour point of view, very expensive. If replicated across each promotion would take a lot of labour to print and display, I’m not sure of the corporate standard for Morrisons but I’d be surprised if it was more than 3 per shelf, Morrisons do use the stripping where inserts display the offer and it’s added to with barkers, it’s use is limited in store and not present in many categories.

|

| Stripping above the line for ease of removal but accompanied by barkers too. |

Another large cost both in labour and in expenditure is print media, specifically overhanging ‘roof’ POS which is displayed extensively in Morrisons. Popular offers being the ‘Price Crunch’ along with ‘Fresh In’ and other special offers. Interestingly Kirkstall doesn’t seem to have any hanging POS which cuts out a lot of overhead clutter and reduces cost. Will this be something else taken from the ‘lab’?

|

| New Style POS at Kirkstall. |

The efficiency movements that were mentioned to go nationwide at the interims are now in place, these were relatively quick wins and made perfect sense. Elimination of hanging pre priced bananas so they were simply weighed at the checkout, as well stopping the outdated process of facing up plus leaving gaps visible so store teams can investigate the reasons for the gap. These process shifts bring standardisation to the estate as with all stores leaving gaps then they can also standardise their layouts to plan which means further savings can be driven with shelf ready packaging solutions.

|

| Leaving gaps on fixture enables investigation and accurate gap scanning. |

Filling the fixture with the wrong stock is a waste of productivity considering that stock has to be removed once the out of stock item is delivered. Not only that but the gap filling process was to drive ‘full fixtures’ which is largely a cosmetic exercise, when it became clear that some stores weren’t stocking the full range and using gap filling as a fail safe then the process was changed to drive efficiency and availability.

‘Respect the planogram’ is something that Dalton mentioned on a couple of Loblaw analyst presentations and interim reports, with Morrisons abandoning gap filling it means that planograms can be implemented and left alone. Previously gaps were filled, tickets moved around and the planogram for the fixture wasn’t never reset, where products were given space for the shelf ready box didn’t then have enough space after gap filling so products were decanted from the shelf ready box to the shelf thus eliminating any labour saving.

Morrisons do operate relatively antiquated systems compared to the competition with the manual ordering system largely abandoned by major retailers in late 80’s to early 90’s, not only have Morrisons kept the system but also rolled it out to their Safeway sites rather than retain their modern Sm3 system.

It is a laborious way to order compared to their rivals with each aisle having an order pad, the colleague / management look at sales history and the shelf position to judge what they need to order. It is a very powerful way to order with Morrisons able to capture uplifts in sales quicker than their automated rivals.

|

| Bedding down allows the order writer to see where further orders need to be placed. |

The leaving of gaps and ‘bedding down’ have further driven efficiency from the arduous task of ordering stock, gaps immediately draw attention to the issue and the practice of bedding down alerts the order writer to low levels of stock rather than facing up to give an ‘illusion of fullness’ . Orders are written in Morrisons after all stock has been worked for the aisle so it’s a very accurate picture.

Morrisons have eliminated the slow moving lines that sell a case or less per week by removing them from the order process and leaving the system to automatically order them. This is based on scans at the checkout and stockholding (as stores count their slow moving overstock weekly). That’s the theory at least, like any system there are issues with orders arriving despite it not being needed and if there is a high volume of slow moving stock, it takes longer to count (and sell) but it’s vital to tell the system what is being held so it can generate accurate orders.

The latest addition to the Grocery process is the gapscan, post night shift fill a colleague will walk around the shop and scan any gaps into the handset. Once that list is generated it allows for gaps to be investigated, some are easy wins as mentioned in a previous blog. Discontinued SELs are removed and other lines that show no issues within the supply chain can be investigated at a store level via the order pad to ensure accountability.

Fresh Food have gap scanned for some time to give the sales managers at head office a picture of what is out of stock after the replenishment overnight. They use this alongside the store counts and sales figures to build a picture of what needs to be allocated to the store.

Despite this extensive manual allocation, it’s firmly believed that the cost of the sales management team is well justified when you consider the savings they deliver with regard to wastage, Morrisons traditionally run below the industry average despite having more fresh food than their rivals. The sales managers also capitalise on a turn in the weather for example working with the vertical integration network able to push through stock at short notice to drive sales too.

As the Fresh food SMS counts have both been reduced from weekly to fortnightly and moved to handset rather than paper then input. It does appears that the next logical step for Morrisons is to move their manual ordering system onto the handset, simply entering the order onto a handset so nothing is missed off (especially with promotions), you could even build in some logic where the system prompted a suggested order to further drive automation.

Its not just in stores that efficiencies are being made, the supply chain in particular have benefited from the roll out of new technology as part of the Oracle suite and are now using voice picking technology along with new management software in the depot centres to further underline their commitment to efficiency.

A new initiative named ‘In-Motion’ underlines Morrisons confidence not only in their systems but also in their network as the new service allows customers to book a Morrisons wagon to pick it up from their factory rather than having to deliver themselves. Whilst there is a cost to the service it does remove complexity (and road miles) from the supplier.

|

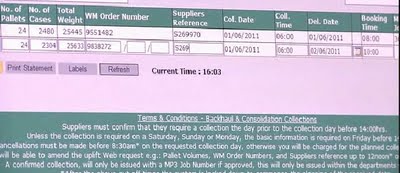

| Morrisons backhaul request screen (c) Morrisons |

The site does explain how the service works (with a nice video) but it also underlines their growing confidence in their systems to offer backhauling solutions like this. It’s basically a case of the customer logging on with their Morrisons order number from the buyer and booking a wagon to collect the order which is then forwarded by Morrisons as appropriate to the relevant depots.

Its another way to drive extra profitability into the business albeit via supply chain and there’s the obvious environmental benefit of having less trucks on the road, Morrisons also point to their benefit of retaining their own in house service teams for the vehicles and are adding even more double deck trucks to the fleet this year to further enhance the environmental credentials.

The initatives above are relatively low risk as their rivals have been doing some of these things for a number of years in some respects, so there is an element of catch up being played but it’s not a desperate chase to do so as the margin holds up despite the cost savings targetted. There is definitely more to go for but these initial ‘low hanging fruit’ are a great start.

There is bound to be a lot more initiatives rolled out as suggestions are acted upon and things are looked at internally, apparently there are some replenishment trials ongoing across the estate where different things are being looked at for replenishment and deliveries. More on that next time out.

Ahead of the opening, signage is now in place and whilst it didn’t warrant a blog piece of its own (the first visit to the store will do!) It’s a brighter colour scheme than was initially anticipated but the windows, door and signage is now all in place and the internals are now being taken care of ahead of the opening later this month.

|

| Side of store – not the shop front as building has been modified. |

|

| I think these are temporary window signs to prevent views inside! |

|

| Signage to the rear of the store down the walkway. |

|

| Hanging sign at the front roadside of the store. |

[convertkit form=2294317]