Think about the last time you were offered cashback at a checkout, does the cashier even ask anymore? Tesco removed this functionality from the checkouts some time ago, meaning the customer has to ask if they want cashback – they won’t be asked.

This step change like countless others are brought in across the Tesco business each year, many make perfect sense and eliminate duplication or unnecessary tasks thus saving hours in store. Not all of them work as intended, there are certain step changes that don’t deliver anywhere near the labour saving anticipated – that’s either over ambitious forecasting by a HQ staffer or the task still needs doing in some way.

Consider that Phil Clarke accepts the business ‘has been run too hard, for too long’ pointing to step changes and the former regime. Indeed he accepted that hours (or lack of) were a huge problem within the business when they started trialing increased hours on certain departments, however it hasn’t solved a great deal.

Most stores have been run under budget for 18-24 months now, so let’s say with all the time and motion studies, finite models in Head office and once all targets are met. Your store is given 5000 hours to complete all the weekly tasks to trade, there are anomalies such as sickness and holidays which still have to be paid but generally speaking – 5000 hours will do it.

What Tesco have done in a number of stores is run them at a lower ratio than required, where 100% = 5000 hours in this instance, Tesco have operated a number of stores under that rate, meaning stores had less hours in which to complete their tasks. Add to that the lack of overtime which anecdotally extended to the previous two Christmas periods – historically blank cheque time for colleagues to work extra hours and you’re heading towards a disaster.

Quite simply, stores were just to continue as best they could with the reduced hours. That means that the shop will get filled up and customers served with a minimal wait in the early days of the hours reduction, staff cope and work that bit harder. The problem is that you can’t run a store like that forever, hours shortages for periods of time are sustainable to a point but it doesn’t take long for things to go wrong and it’s a domino effect once they do.

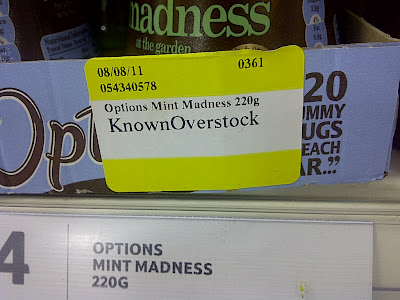

|

| A lack of staff means ex promotional stock like this isn’t replenished when the deal is active. |

Tesco do the majority of their replenishment overnight to benefit from better case rates (due to less customers meaning more work output), the day shift tidy around and fill up key lines like Fresh, Produce and promotional lines. The theory behind Grocery is that the shelf will hold a day’s sales (minimum) so that shouldn’t need to be touched, meaning staffing on the day shift is minimised and the focus can shift to serving the customer and tidying.

In a nutshell, that’s how it should work. The problem is retail is just too variable – busier than expected times such as the great April weather we had last year will drive volumes up into store meaning more staff needed to serve and replenish. The snow also wreaks havoc with late deliveries needing to be offloaded and replenished at different times of the day along with variable demand on staples like bread and milk..

The ideal store operation only works when the night shift are fully staffed, well managed and able to clear all their deliveries and relevant overstocks ensuring the shelves are fully replenished and any gaps are true gaps – not hidden in a full warehouse for example.

Once the night shift stop clearing the delivery, things back up and control is lost very quickly. It sounds strange but stores with full warehouses suffer with poorer availability than those with empty warehouses. The problem being that when the warehouse is empty and stores are confident any gaps are genuine – it’s over to the system and distribution to resolve those gaps and send in the stock.

With a full warehouse, store staff can’t scan the gaps with confidence as they aren’t sure whether the stock is within the warehouse or is genuinely not in store. 9 times out of 10 stores will scan the gap and remove any stock held on the system in order to fill the gap, the problem being what if the stock is then found in the warehouse and replenished? The shelf is full and more is on the way – filling up the warehouse, multiply this by 10-20 products across 1000 stores and you’ve got a big problem with stockholding.

It’s not just stockholding either, shrinkage (that is stock loss via unrecorded methods – theft etc) is another KPI that store managers are targeted upon, it’s a hard one to achieve but with the focus on availability and ensuring the correct controls are followed through to avoid shrinkage, then it will go in the right direction.

Bearing in mind that any sales are recorded via the checkouts, so as the item is scanned it’s removed from the inventory record. By and large this works well and manual intervention is only needed for the 20% of problem lines.

Any stock removed on the system but later found when counting is a ‘surplus’ but remains as a needless overstock, tying up working capital for the business. Instances like this are more common when teams don’t have the time to complete routines properly – allied to night shift not clearing is day shift on checkouts and unable to complete counts accurately.

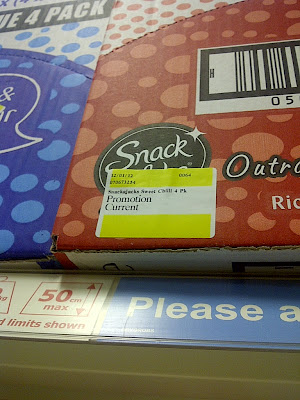

|

| Admittedly Asda OOS madness – but a good example. |

To show how shrinkage works, the label above is a good reference point. Nevertheless it’s from Asda but the same information is available to the guys in Tesco via their PDA.

The first number on the right is PI Qty (Inventory) – that is the stock that the system believes to be present. In this case the system believes there to be 96 jars of 200g Nescafe within the store.

The system wouldn’t automatically re-order any Nescafe at this inventory level. The precise algorithm to re-order differs for each retailer, product and product group. Fresh foods is forecast based, so allocations / orders are made based upon forecasted sales and a consideration of wastage (reductions and disposals) as the items are date sensitive. There are further differences with ready meals being far shorter life than say Butter or Juice.

Grocery is space driven, so you tell the system how much space is given up to fill that shelf and the system will work to fill the shelf. In some cases you can overstate the physical space to gain more stock – especially if in a smaller store or if the line sells particularly quickly.

|

| Fast moving lines are marked in store as ‘best sellers’ |

Tesco identify the facings of each product on Grocery and then ‘cube’ to tell the system how much they can get onto the shelf, once that is set as a capacity – the system will work to fill the shelf. It may bring in some forecasting information too, the Asda system does work on some forecasted sales information too.

In the case above, let’s say that there are 96 jars in the warehouse (as the system thinks) but they can’t be found due to time constraints, there’s 45 cages and you’ve been on checkouts for 4 hours. There’s a gap and it’s a key line, you decide to zero the inventory to drive another order and satisfy customers.

Those 96 jars have to go somewhere, so it’s on the shrinkage bill. It’s hard to pin down where the 1 / 2 items go sometimes, and indeed in cases of batteries or high value cosmetics most can be put down to the theft.

So – 96 jars x @ £5.29 = £507.84 – that’s the particular bill for that line and zeroing the record. Once the stock counts are done though, that ‘loss’ will be adjusted, the counts are done across the store over 13 weeks, so each area is counted per week.

There are a great number of other elements in the mix, checkouts not scanning a line properly means it won’t deduct from the inventory file. Depots don’t send in what they are supposed to, so the delivery order is received but the 3 cases of crisps never arrive – or the depot send something else in error meaning a loss on the Walkers crisps but 3 extra cases of Pringles.

You can’t investigate everything but counts are then re-checked and signed off to eliminate errors. It’s very difficult for stock controllers to achieve this with checkout pressures, other colleagues not able to replenish in time and the night shift continually falling behind – it creates a perfect storm and this is what we’ve seen in stores.

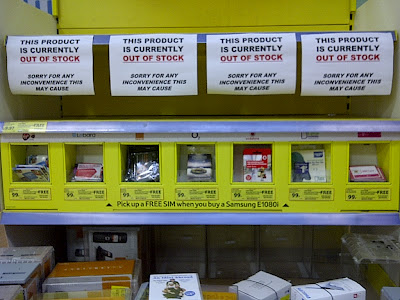

|

| System ‘knows’ this as overstock – so no further deliveries should arrive. |

Back to step changes, a major one for the warehouse and stock control operation was the ‘Stock reduction process’ which involved reducing the warehouse space with a greater focus on checking overstock. Sorting the warehouse into areas for promotional items, ‘must fill’ (best selling lines) and thorough investigation of overstocks. Each case of overstock is assigned a reason by the system and overridden if the root cause is different, presumably this is fed back to buyers and allocators at HQ to remedy the next time out.

There was a rumour that this warehouse space focus and subsequent reduction would lead to stores taking back some warehouse space for an expanded offering, be it extra counter space or indeed Tesco Bank. This hasn’t come to fruition, especially as stores need the extra space when seasonal periods come along.

|

| Non food lines have their capacities locked by HQ. |

One of the stranger moves from SRP was that non food capacity lines were locked. On food, stock controllers can adjust the shelf capacity to drive more stock into the store for quick sellers, and ensure that the capacity is accurate for the shelf space given up for the product.

However on non food, the capacities are locked at HQ level so stores are unable to adjust, of course this means that the planograms sent down must be adhered to otherwise the whole process won’t work and stores will laden with stock and have no room on shelf for it. As we know within retail, each store is variable and things aren’t always the same – locking capacities seems a strange move.

|

| Seems somewhat futile scanning lines that are on promotion – some overstock will be increased volume. |

One can assume it’s related to Phil Clarke saying that Tesco ‘had to work harder on non food’ with the ranges and general slowdown. If stock has arrived into depot and isn’t being taken by stores due to poor sales and stores adhering to capacities. The capacity move is likely to drive stock into stores and free up depot space, one thing is for certain, the job of a non food stock controller must be frustrating given this lack of control.

Aside from counting and investigating overstock, there is little else that can be done to remedy high overstocks, especially if ‘capacity’ is the issue. There is the option to escalate erroneous capacities to HQ where they are adjusted, but when the option exists for it to be done in store on a PDA for food, why not non food? Let the store control their stock!

The system by and large works well on the availability side but there are several opportunities to further drive improvements on the goods receiving side, especially where deliveries are received. When the system was built and commissioned, it was never intended to support the amount of stores that it currently does. Phil Clarke is of course a former IT director for Tesco and some have indicated that some of the improvements introduced in his tenure aren’t working correctly and are needing the £28m upgrade pledged last year.

The IT systems when built were never envisaged to have to support a bank either and have that element feeding into the financial reporting software, certainly when systems were cutover from RBS to Tesco software, there were issues with customers being locked out of their accounts for days.

|

| Main POS on the shelf is turned over but the header board displays the ‘new’ offer. |

Price Integrity is another issue where Tesco can struggle, the ‘end of day’ process can take far longer than usual which means price updates aren’t loaded into the system in time for opening, meaning several stores are thus trading illegally with incorrect prices displayed. The legal issue aside (I’d estimate every single supermarket technically trades illegally as it’s virtually impossible to have every price right.) it does impact the store as refunds have to be given (double the difference) and it erodes trust between customer and retailer.

|

| Promotional POS not on display as offers failed to cut over onto system. |

A promotional change (w/c 13th Feb) failed to cutover onto the main system which meant that promotions and price reductions that were set up in store didn’t scan correctly at the checkout leading to yet more refunds and queues at the customer service desk.

Naturally – it’s not just the lack of staff or system hiccups that are an issue facing the business. I know the analysts have been peddling the tale that £200m / £300m will be invested in Butchers, Greengrocers and Fresh food replenishment staff to enable shoppers to interact with staff when the visit stores. For me, the problem goes further and deeper than a lack of staff, it’s far wider reaching – as these two blogs will hopefully show.

We know that staff numbers are an issue. Phil Clarke has admitted as much and pledged to invest some money in staffing come April. Some stores have had trials going on where Produce and Fresh Food have a greater staff coverage but it’s not really the solution as it essentially robs Peter to pay Paul.

Indeed I visited one of the hours trial stores and it was worse than the normal stores I visit, the Produce team looked smart in their green uniform but there was the usual checkout relief calls and huge gaps on the shelves. The management team seemed to congregate on various aisles and have a ‘team rumble’ with 5/6 tidying the excess cardboard.

|

| It’s all in the standards… |

Rumours are beginning in stores of a pending investment with some stores already recruiting, other stores cutting even more hours but all stores are now going through a process of matching their existing staff to the correct hours to ensure that any ‘gaps’ can then be filled (presumably) with the new hours allocations. It’s worth noting that the hours match process goes on in stores fairly often as trade patterns and people’s needs change.

Below I’ll try review of the Tesco business areas and the challenges they face. It’s still brilliantly profitable as an enterprise but nevertheless, their current woes shouldn’t be underplayed.

Customer Service + ‘the customer’.

The most important aspect of any business, especially retail and especially since the competition are ever so strong these days. Adding social media and forums to the mix and you’ve got a very effective communication channel for disgruntled customers to use, thousands of users on Facebook and Twitter pages means the word gets out there.

Admittedly, some complaints are relatively trivial, store level issues like out of stock lines or ‘why doesn’t Peterlee sell Caerphilly cheese?’ But there are the wider complaints, around service, lack of staff or the 10 minute queue.

Tesco ‘running the business too hard for too long’ have left themselves exposed to these sort of complaints for a while and like a restaurant that goes downhill, it’s the same for Tesco as word spreads about long queues at checkouts and poor service.

Half the time, the only interaction you get a serviced checkout is to be asked for your clubcard or to tell you the sub total, finding staff members on the shop floor during busy periods can be another challenge.

The poor service delivered by staff who are stressed out after being called to checkouts for the 5th time that morning, (whilst their own job doesn’t get done and they continue to fall further behind.) Gaps appear on shelves and routines around stock control and pricing don’t get done. Morale slips within the stores and generally absence increases, more queues form at customer service as customers queue for their refunds due to overcharges (the pricing team being on checkouts is a remedial cause).

It might seem a ‘exceptional’ case that I’ve outlined above but generally that’s how it tends to go within stores, perfect storm created and knock on effects galore. Not the fault of staff, it must be very difficult in store and the fact that it’s been acknowledged at the top level does indicate that things may get better. However as one staff member said to me ‘I’ll believe it when I see it.’

You have to ask if ‘Every Little Helps’ is still relevant, introduced in 1992 when supermarkets weren’t overly developed in some areas, so extra services like bag packing was a big thing. We now expect so much more from our shopping trip, and Tesco aren’t getting the big things right anymore.

The core purpose for the Tesco business is ‘creating value for customers to earn their lifetime loyalty.’ A bold pledge and a good ‘purpose’ but it’s a bit running before you can walk. You are only as good as your last shopping trip and Tesco have notably fallen well short in recent months. Indeed, looking towards gaining the next shopping trip would be a good focus rather than getting ahead with ‘lifetime’ loyalty.

Of course these ‘purposes’ are long term targets and naturally difficult to achieve but given the woes in the market with poor lfl results, refocusing and looking at the detail of a single shopping trip and making that better, trip by trip would see them resolve a lot of the issues. Working from the ground up.

Customers don’t care that Tesco save 100’s of hours per store by installing self checkouts, they do care when none of them are working meaning they have to join longer queues.

If you’re impacting the customer, then you’re not saving hours as you’ll lose the spend. They’ll happily go to a rival, Tesco for too long has focused on saving rather than serving.

Store Standards / POS / Retail Standards.

With fewer hours comes poorer standards and the level of tolerance for poor standards increases, after all ‘you can’t have champagne football on beer money.’ Tesco have allowed the empty cardboard to accumulate on shelves for a good few years after realising that presentation cost more than it ever generated in sales. There are store teams ‘rumbling’ to tidy the shelves for an hour each day now but gone are the days of a squad of grocery staff tickling the bottles of pop. It’s all about shelf ready solutions.

|

| Fresh Produce promotional ends on Sunday – 2pm. |

With the efficiency drives, a lot of the day staff have been lost bar a skeleton crew to carry out key replenishment, date checks, reductions and fill up fresh food. The small army of stock controllers have also been reduced as tasks such as controlling the levels of promotional stock have been taken away and given to head office to control.

|

| Offer ends Tuesday but this was Sunday! |

As covered above, the skeleton crew can cope when nightshift clear their work and checkouts are covered, however when things start to go wrong then the skeleton shift can’t recover the store, promotional ends aren’t replenished and stock builds up. Once the promotion ends, sales rates slow down and the warehouses fill up.

|

| Top stocking at Christmas – this doesn’t work at all – there’s no space for the overstock. |

|

| ‘home made’ non corporate signage at the Phone Shop |

The POS package looks notably cheap and doesn’t look like what you’d expect from the market leader. The POS, gondola ends and SEL’s feature yellow prominently which isn’t even within the corporate colour scheme so seems a curious choice. Red / Yellow isn’t within the Asda template either but it’s difficult to operate with Green POS!

|

| This looks so poor – it’s an absolute basic. POS good but execution poor. |

|

| HQ generated POS looks better than the in store generated counterpart. |

|

| Store generated POS – Product description too small – mis-aligned – looks poor. |

|

| No Pound signs on this POS? |

|

| Printer ink used to the maximum – unreadable description and poor appearance. |

There isn’t masses of the HQ generated POS so stores generate their own POS for ends and other secondary space, it often isn’t set up correctly on the system within the borders and with the cost control situation, stores are using ink cartridges till the very last drop which impacts the POS quality and subsequent impact.

|

| Yellow overkill, even in revamped Extras. No ‘wow’ with the advertising. |

There is also far too much yellow associated with the ends, the chopping ‘£’ symbol represents time gone by as price isn’t the only weapon in the armoury anymore, there is much much more to the 2012 customer than price, as evidenced by the astonishing rise in sales at Waitrose.

The move to abandon ‘barkers’ on the shelf was taken around 2 years ago and saw any promotional advertising printed directly onto the SEL and that was displayed next to the product. There was no additional signage on the aisle directing customers to offers, that was it. Any extra promotional advertising is only displayed on the promotional ends and again, there was a step change and stores lost hours based upon not having to print and site additional advertising.

|

| Not all Ken Homs on the meal deal- what is? Difficult with just SEL space. |

It doesn’t make offers particularly clear though, certainly on the more complex offers, the space simply isn’t there to be able to advertise sufficiently. Additionally some categories where promotions are commonplace (Crisps for example) means the aisle turns into a sea of yellow without any particular distinction.

|

| JS lead the way with POS – pictorial barkers – clear and concise. |

Sainsbury’s lead the way with the POS package and the image above indicates why, admittedly these are head office generated advertising, but the new font family and theme all look a cut above. The in store generated adverts need work, as does the yellow SEL’s to bring it up to scratch and appeal to customers.

|

| Price drop POS sharper but look at the standards…. |

The price drop POS has been a noted improvement but it seems like the last ‘big’ launch was this time out, further guises will be incorporated within the standard package of promotions. Whether it resonates for customers entirely isn’t clear at all, the poor results indicate it’s not worked and I must admit, it’s not clear to me whether these are long term cuts or like the rollbacks of Asda fame.

The Stores:

The shopping experience has diminished somewhat within Tesco, the lack of staff, patchy availability and creaking stores means the overall experience isn’t what it could be.

The experience is vastly the same as it always has been, vast selling sheds with battles on quality (Finest), Discounter brands (Aldi, more on those in part 2) and price (Asda). It’s broadly the same as it always has been but perhaps under Sir Terry, before the hours cuts really bit – they were coldly efficient.

Whereas now, it’s been cut back too much, maintenance budgets didn’t escape the cuts and the roof leaks, some checkouts break down and the entire experience feels tired and somewhat depressing with poor availability, lack of staff and subsequent queues to contend with.

|

| Unsurprisingly this didn’t work. |

What of the store environment? In the most polite way possible, you’re more likely to shop at a Morrisons store of the future than a Tesco Extra new build. Maybe the exception is the Dudley ‘new extra format’ but that’s yet to be visited by the blog (it’s in the pipeline though.)

|

| This was a refitted Extra store – poor standards. |

Asda are notably under whelming when it comes to their store formats, painting a few walls maroon is about as far as they go with regard to new concepts in stores. Whereas Sainsbury’s are continually innovating as they try to expand their existing stores as well as build new ones, their Heaton Park store was a prime example of a very strong XL offer

|

| St Albans – Morrisons store of the future. |

The Produce department along with Fresh food is an area targeted for a revamp with the extra staff coverage but it’s still relatively utilitarian with green crates and uninspiring displays. There needs to be a rethink around the fresh departments for them to be destinations in their own right but increased staff coverage would at least help them achieve their primary aim of trading and selling food.

|

| Monday afternoon (2pm) in an Extra – standards not strong enough. |

|

| Same store – Monday afternoon – 2pm. |

Of course these are store ‘standards’ rather than store fit out but the green crates / empty boxes and units don’t do much for the presentation of the department when it’s full! There has to be another look at the display methods for Produce, especially with the recent developments by Morrisons and Sainsbury’s.

A recent trip to London presented an opportunity to visit the much lauded Tooley St Metro by London Bridge, a full blog report will follow but is this the ‘future’ of the Metro / Express format?

|

| A larger focus on Fresh food in a Metro environment. |

The store seems to take heart from Morrisons push on freshly prepared food in Ilkley and also elements of stores of the future and indeed the Fresh and Easy US model by offering more fresh food in a warmer environment.

|

| Better signage and better colours. |

There isn’t as much of a sterile shopping experience within this store (it does remain though) and it does feel ‘warmer’ than other Tesco stores, certainly many a Metro are now in dire need of revamping as they’re suffering with a busy trade and less staff to cope.

|

| Entry to Tooley St – Clear division in store and very ‘fresh & easy’. |

I’ll touch more in the forthcoming blog on the store itself but I wanted to share some pictures to show it’s not all doom and gloom. Personally I’d have liked Tesco to go harder on the fresh food element as although it takes more staff to prepare, they could really push the fresh product. The store is around the corner from a large group of offices including the HQ of Ersnt & Young accountancy so they’ll never get a better chance to really trial some of these concepts.

|

| New bulkhead signage adds a greater air to the department but ‘green crates’ remain. |

Part 2 to follow – covering own label offering, Non Food, Clubcard, Social Media, marketing and .com issues plus an overall summary of the business, let’s be fair. It’s a blip, a long time coming perhaps but eventually it happens. They’ll still make £3bn + profit this financial year and remain a powerhouse of the British economy.

They’ve just go to re-focus, hopefully this and the secondary blog will try clear up some of the issues and what can be done to recover. Focus on serving rather than serving!

Phil Clarke has had a year in the role now, he will be hoping his April plans deliver tangible progress. The Tesco price guarantee (reduced to a max £20 redemption after customers were getting vouchers of £100+) and Big Price drop have been underwhelming to say the least.

He’ll be hoping his April investment is a case of third time lucky.

[convertkit form=2294317]